Fintech - The New Dawn of Banks and Other Financial Services

Fintech, often known as financial technology, is one of today's most revolutionary services. In reality, firms based on the same services are emerging in the market. The fintech industry is quickly transforming traditional financial assistance to make them quick, simple, affordable, and accessible.

This is done with the use of technology-enabled goods and services. The primary advantage of financial technology is that it empowers the general populace to make their own decisions and live financially successful lives. More than ever, the available people are becoming more financially literate. In essence, Custom Fintech software development simplifies the lives of banking consumers by fusing traditional financial services with cutting-edge digital technologies and Big Data offerings.

What is Fintech?

By combining the phrases financial services and digital technology, the name "FinTech" is created. The fundamental idea behind finance technology is that it encourages numerous businesses to employ digital technologies in financial areas, including big data, alternative finance, internet banking, mobile payments, and general financial management.

Initially, the back-end systems of banks and financial institutions were where the fintech industry began to take shape. But its definition has drastically evolved since then. The fintech industry and its exposure have changed and become more inclusive nowadays. It includes a number of consumer-based applications. Since 2019, this technology has been used to manage your finances, trade stocks, and purchase insurance and groceries.

Numerous fintech software development companies have provided fintech services and assistance for banking, which has completely changed how customers access their funds.

Investment and insurance firms, as well as mobile payment platforms like Square, are all affected. This significant effect of FinTech can also be considered a possible threat to conventional or brick-and-mortar banking. Neobanks are constantly evolving, which are issuing thousands of progressive changes from physical, brick-and-mortar banks and these changes are being implemented by advanced fintech operations.

This article will go through the major points of how Fintech software development has impacted these organisations.

Read Also: The Ultimate Details About Fintech App Development in 2022: Tech Trends Acing the Race

What is the Current State of the Fintech Industry?

Before we get into how any Fintech app development company fuels financial services innovation, let's start with a few market data.

Fact #1: According to market analysts, there will be significant changes to global financial institutions in the following years, most of which are expected to be disruptive.

Fact #2: Financial institutions like Citigroup, Banco Santander, and Goldman Sachs are among the major investors in FinTech firms, demonstrating their interest in the rapidly developing industry. If you examine the US market, for example, FinTech companies received 63% of all investments made in the banking sector.

Fact #3: It is frequently observed that startups with headquarters in China and the US are valued at over $1 billion. Once more, it was evident that the fintech sector was expanding at a breakneck speed. However, Covid-19 obstructed traffic and halted efforts to promote the FinTech sector. CBInsights reports that the first quarter of 2020 was among the worst in the previous two years for FinTechs supported by venture capital companies.

There have only been three new unicorns introduced. In Q1 of 2019, there were eight emergent organisations for comparison.

New Participants:

1. Pine Labs, a cutting-edge merchant platform that accepts several payment methods, is valued at $1.6 billion.

2. Another unicorn, Flywire ($1 billion), helps businesses optimise their payment processes while removing obstacles to doing so. Under challenging circumstances, consumers try to steer clear of dangers and work solely with reliable, reputable financial institutions.

3. HighRadius ($1 billion) is a SaaS platform for businesses that use autonomous systems with artificial intelligence.

Another Philadelphia-based financial startup is Cred.ai. It has also proved to be worth it. It successfully secured approximately $18 million in Series A investment. Cred.ai bills itself as a bank substitute and provides a sturdy metal credit card with no annual fees, interest, credit enhancement, self-destructing account numbers, and other benefits. Millennials and Gen Z are its intended audience.

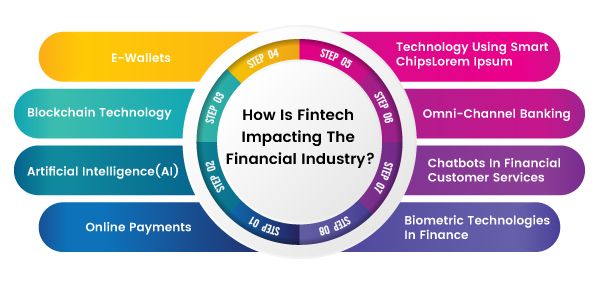

How is Fintech Impacting the Financial Industry?

To a significant part, the FinTech industry is responsible for fostering cashless payments by promoting the use of UPI, Aadhaar, and biometric verification to make payments, transfer money, and withdraw cash from bank accounts without visiting bank offices through a fintech software development company. Economic growth is being spurred by the increased usage of cashless payment systems, making digital payments more accessible, faster, and more convenient with UPI. This results in a banking system that transfers money on digital payment platforms using fintech applications.

FinTech is rapidly changing the entire structure of the banking business, with some institutions already implementing digital, paperless, and cashless operations. Several factors have contributed to the expansion and growth of India's FinTech ecosystem, including increased smartphone availability, greater internet access, and high-speed connection. FinTech's growth in India will be assisted by growing collaboration with conventional banking, insurance, and retail sectors, all of which are aggressively adjusting to changing client requirements.

Digital payments are guaranteed by security and government action, eliminating the possibility of uncertainty and fraud. In partnership with people's trust and demands, the FinTech sector is developing more and more straightforward methods of enabling cashless payments in the marketplace.

Technology Using Smart Chips

Currently, the financial market scenario is evolving with semiconductor technology. Smart chip ATM cards have made a significant contribution to reducing the financial losses that might result from accidents. A designated EMV technology is included in this specific chip technology as well. Additionally, each transaction made with this technology requires a one-time password. The security of the transactions is improved with the aid of this one-time password. Therefore, he won't be able to do anything, even if it is stolen.

Banking officials strongly advise customers to memorise their pin codes to avoid unnecessary problems or difficulties. These bankers are always seeking new methods to protect their clients from theft and fraud by offering the highest level of protection. The archaic magnetic stripe technology is more susceptible to fraud since it utilises the same pin for all transactions as opposed to the smart chip technology that is powering financial transactions these days. Smart chip technology is growing in popularity; before long, there will be chips in almost every card. However, you can visit ATMs and make totally cardless payments. It is useful as you are not physically contacting the machines or anything. It has dramatically helped reduce the viral pandemic, especially in places like India, where fintech is still in a nascent phase.

Biometric Technologies in Finance

The critical reason biometrics have been steadily included in FinTech apps by the fintech software development company is that they facilitate user login and access to cloud-based financial services quickly and efficiently. Today's industry analysts additionally consider biometrics as a substitute for increasing the security of FinTech apps to safeguard trust and privacy. It appears that biometrics might lessen the leaking of personal information by making FinTech application identification more straightforward. Recently, a payment system has been completed using facial recognition. Face authentication really raises the bar for both security and user experience.

Security identification during the login process has grown in importance as FinTech has started to set the direction for future financial services growth. People are increasingly and regularly signing on to their online bank accounts to quickly check their status or make payments.

The user will lose faith in the service provider and terminate the engagement if they are unable to offer 30 seconds of automated identification for 60 seconds of transactions. Therefore, consumers' security demands must be adequately taken into account by FinTech developers, who should also provide them with the necessary security measures. FinTech must offer enough security in relation to addressing the level of risk.

Omni-Channel Banking

Using online, social, and mobile channels instead of a branch-specific approach, fintech financial services are entirely changing the banking industry. Additionally, it reduces the bank's reliance on its physical branches. As a result, we observe that many banks have adopted omnichannel banking, decreasing the number of branches. By the end of 2016, around 9100 bank locations in the European Union had been closed.

Online Payments

Many elements of our lives will alter due to the new wave of digitalisation, especially in emerging countries like India. Even those with modest degrees of digital literacy and competency with new methods of performing tasks are putting their toes into the modernisation pool. Particularly for payments, people have developed a digital operating system. Everyone prefers cashless transactions because they mix with ease and security. After the epidemic, cashless and digital payment methods have become the most popular ones.

Unified Payments Interface, or UPI, is, without a doubt, the most frequently utilised digital payment system in the nation. Another example is RBI's introduction of UPI123Pay, which enables feature phones to switch to digital.

AEPS is a bank-led payment methodology that enables owners of Aadhaar numbers to conduct financial transactions from their Aadhaar-linked bank accounts utilising Aadhaar-based biometric authentication. In March 2022, AePS handled 225 million transactions totalling Rs 28,522 crore.

Chatbots in Financial Customer Services

Financial services are undergoing rapid digital development to meet the expectations of digital-native consumers. With an anticipated 3,150% increase in effective chatbot interactions between 2019 and 2023 and an estimated 862 million hours saved for enterprises in the future, it's evident that chatbots will alter how organisations communicate in the future.

Finance chatbots conduct discussions using text or buttons rather than direct contact with an actual human person. They are available 365 days a year, beyond any human presence, and can answer queries 24/7, resolving typical problems fast. Resetting a password, monitoring transactions, or even putting up a line of credit is straightforward and smooth with the aid of these chatbots. Furthermore, banking chatbots may manage numerous queries at the same time.

E-wallets

One of the most influential pieces of evidence of the expansion of FinTech financial services is the massive increase of E-wallets. Some of the world's largest e-wallet firms include Samsung Pay, PayPal, Android Pay, and Apple Pay. These wallets are used for a variety of applications, including P2P payments, foreign transfers, top-up & utility bills, ticket booking, and many others.

Starbucks and Walmart Pay are two examples of solo wallets. E-wallets have been able to attract customers owing to their enticing services, which include exciting deals, generous cashback, and reward points, among other things. Because of their enormous success, many institutions are increasingly discovering their significance and seeing e-wallets as a collaborative strategy to embrace technology changes.

Artificial Intelligence(AI)

AI in FinTech is utilised for a variety of reasons, including loan decision-making, customer assistance, fraud detection, credit risk assessment, insurance, and wealth management. Modern FinTech organisations are using AI to improve efficiency, accuracy, and query resolution speed. AI fosters innovation in FinTech, resulting in personalised, rapid, and secure services with increased consumer satisfaction and worldwide reach.

Artificial intelligence in FinTech may forecast a user's behaviour using AI APIs, which can also be used to benefit banks and FinTech enterprises. Assume the user makes a single request for information about their spending in the previous month. Using AI, you forecast their follow-up request (e.g., income during the last month) on the server side and supply this information in the same answer. Consequently, you reduce the number of queries and the burden on your system. If the predictive analysis is factual, the user also benefits since the system operates more quicker.

Blockchain Technology

This is one of the most significant financial technology revolutions that has swept the globe. It is expected to disrupt established economic systems. Simply put, it is a continually updating digital-ledger system in which technology is utilised to build blocks and record transactions forever, with no way to change the information. Banks are investigating the possibilities of this technology, altering how money is exchanged, transactions are confirmed, and records are kept. It is anticipated that it will change KYC systems, clearance and settlement systems, loan and credit applications, bookkeeping, and auditing.

What are the Main Benefits of Fintech in Banks?

Summarising the preceding, fintech's effect on the future of banking will be the most evident in such aspects:

1. strengthening competitiveness;

2. improving customer service quality;

3. lowering the number of physical bank branches and human resources;

4. maximising work process efficiency;

5. opening up new investment opportunities;

6. offering end-to-end security;

7. optimising risk management procedures

All of these forecasts regarding the influence of fintech on banks promise us a significant expansion of the fintech industry: according to projections, the global fintech market will cost around $309.98 billion in the following year, 2022 (in 2018, the same numbers were only about $127.66 billion).

What are the Main Difficulties Being Faced by the Fintech Industry?

Fintech in many industries, particularly banking and finance, has three significant issues that must be addressed as soon as possible.

One of the primary issues of the Fintech business is cyber security. Many opponents are concerned about the confidentiality of the data. The banking and financial sector's digitalisation leaves it vulnerable to cyberattacks. Therefore it is a lesson for the government and private sectors to work together synergistically and ensure that their systems are robust and resilient enough to prevent the release of sensitive and confidential data.

However, customers must be able to accept and trust the evolving systems. Fintech services are predicted to supplant traditional banking and financial services, which continue to be difficult for consumers with conservative attitudes.

Chatbots and artificial intelligence (AI) is projected to replace human communication. This might be a significant impediment to expanding numerous sectors that use fintech technology to service their consumers. As a result, businesses must constantly strive to maintain a personal touch while meeting client requirements and satisfaction.

What is the Future of Fintech in India?

India has risen to prominence meteorically as a leader in Fintech innovation. Financial technology is transforming the lives of Indian residents and paving the way for developing a digital economy. Fintech businesses will undoubtedly find several possibilities to benefit in the "Digital India" age. The Government of India has launched the 'Jan Dhan Yojana' plan, which seeks to create a bank account for every person. Furthermore, to popularise cashless transactions, the government has granted tax breaks to merchants who accept more than 50% of their payments using an electronic payment system. Banking digitalisation will make fintech technology the future of banking.

Conclusion

We hope this has helped you understand why banks need fintech. As can be seen, banks that employ fintech app development services may offer themselves long-term opportunities for successful development and firm competitiveness.

FinTech and digital banking have no borders and are not confined to a single area or country. They live among individuals who have a vision and are prepared to take the necessary steps to usher in a new age. Over the next several years, the character of bank clients will shift, with millennials playing more essential roles in the global economy. Such clients compare or will begin to compare their Google and Facebook experiences with their financial service providers' experiences.

FinTech is a method of providing relevant items to your customers. Things evolve rapidly, and if a company can't stay up and fulfil the expectations of its current clients, they have other alternatives. FinTech, as a whole, is redefining the entire spectrum of how we interact with clients.

Popular Tags

Recent Posts

Why AI-Powered Software Development is the Key to Unlocking Business Growth in 2025

AI Application Development in 2025: What Every Business Should Expect and How to Prepare

How To Choose The Right Software Development Company For IT Resource

ChatGPT for Commercial Use: How to Enhance Any Business With AI

We are at